Exchange-traded funds

Exchange-traded funds (ETFs) allow you to diversify your portfolio with assets that track bonds, commodities, and indices, without the high cost of owning the underlying assets.

Exchange-traded funds

Exchange-traded funds (ETFs) allow you to diversify your portfolio with assets that track bonds, commodities, and indices, without the high cost of owning the underlying assets.

ETF trades available on Deriv

CFD trading allows you to trade on the price movement of an asset without buying or owning the underlying asset.

On Deriv, you can trade CFDs with high leverage, enabling you to pay just a fraction of the contract’s value. It will amplify your potential gain and also increase your potential loss.

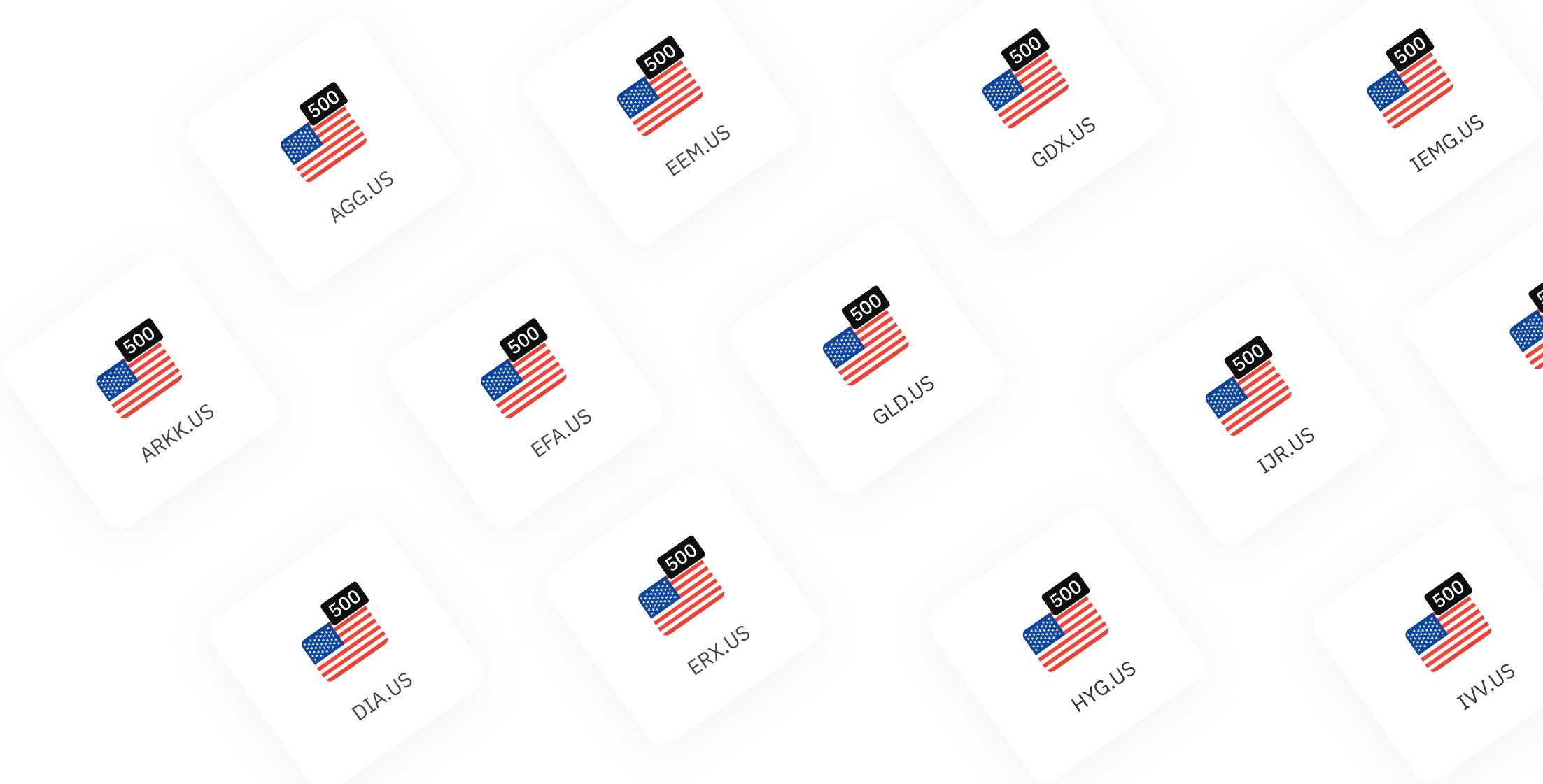

Instruments available for CFD trading

ETFs

AGG.US

ARRK.US

DIA.US

EEM.US

EFA.US

ERX.US

GDX.US

GLD.US

HYG.US

IEMG.US

IJR.US

IVV.US

IVW.US

IWM.US

LQD.US

QID.US

SDS.US

SLV.US

SPXS.US

SPY.US

TBT.US

TQQQ.US

UNG.US

VEA.US

VNQ.US

VOO.US

VTI.US

VWO.US

XLE.US

XLF.US

XLK.US

AGG.US The iShares Core US Aggregate Bond ETF tracks an index of US investment-grade bonds.

ARKK.US The ARK Innovation ETF invests in domestic and foreign equity securities of companies that rely on or benefit from developments in artificial intelligence, automation, DNA technologies, energy storage, fintech, and robotics.

DIA.US The SPDR Dow Jones Industrial Average ETF Trust tracks the Dow Jones Industrial Average index.

EEM.US The iShares MSCI Emerging Markets ETF tracks an index of large- and medium-sized stocks from emerging market countries.

EFA.US The iShares MSCI EAFE ETF tracks an index of large- and mid-capitalisation developed market equities outside of the US and Canada.

ERX.US The Direxion Daily Energy Bull 2X Shares tracks the Energy Select Sector Index.

GDX.US The VanEck Vectors Gold Miners ETF mimics the NYSE Arca Gold Miners Index, which tracks the overall performance of companies involved in the gold mining industry.

GLD.US The SPDR Gold Shares ETF tracks the price of gold bullion in the over-the-counter (OTC) market.

HYG.US The iShares iBoxx $ High Yield Corporate Bond ETF tracks an index of US dollar-denominated, high-yield corporate bonds.

IEMG.US The iShares Core MSCI Emerging Mkts ETF tracks an index of large-, mid-, and small-capitalisation emerging market equities.

IJR.US The iShares Core S&P Small-Cap ETF tracks the investment results of an index of small-capitalisation US equities.

IVV.US The iShares Core S&P 500 ETF tracks the performance of an index of large-capitalisation US equities.

IVW.US The iShares S&P 500 Growth ETF tracks the performance of an index of large-capitalisation US equities with above-average growth characteristics.

IWM.US The iShares Russell 2000 ETF tracks the investment results of an index of small-capitalisation US equities.

LQD.US The iShares iBoxx $ Investment Grade Corporate Bond ETF tracks the performance of an index of US dollar-denominated, investment-grade corporate bonds.

QID.US The ProShares UltraPro Short QQQ ETF seeks to produce two times the inverse of the daily returns of the Nasdaq.

SDS.US The UltraShort S&P500 ETF seeks to produce two times the inverse of the daily returns of the S&P 500.

SLV.US The iShares Silver Trust ETF seeks to reflect generally the performance of the price of silver.

SPXS.US The Direxion Daily S&P 500 Bear 3X Shares ETF seeks to reflect 300% of the inverse of the performance of the S&P 500.

SPY.US The SPDR S&P 500 ETF tracks the S&P 500.

TBT.US The ProShares UltraShort 20+ Year Treasury seeks daily investment results, before fees and expenses, that correspond to two times the inverse of the daily performance of the ICE US.

TQQQ.US The ProShares UltraPro QQQ seeks daily investment results, before fees and expenses, that correspond to three times the daily performance of the Nasdaq 100 Index.

UNG.US The United States Natural Gas Fund ETF tracks in percentage terms the movements of natural gas prices.

VEA.US The Vanguard FTSE Developed Markets ETF tracks a benchmark index that measures the investment return of stocks issued by companies located in Canada and the major markets of Europe and the Pacific region.

VNQ.US The Vanguard Real Estate ETF tracks the return of the MSCI US Investable Market Real Estate 25/50 Index.

VOO.US The Vanguard S&P 500 ETF tracks the S&P 500 Index.

VTI.US The Vanguard Total Stock Market ETF tracks the CRSP US Total Market Index.

VWO.US The Vanguard FTSE Emerging Mkts ETF tracks the FTSE Emerging Markets All Cap China A Inclusion Index.

XLE.US The Energy Select Sector SPDR® Fund ETF tracks the energy sector of the S&P 500 Index.

XLF.US The Financial Select Sector SPDR® Fund ETF tracks the financial sector of the S&P 500 Index.

XLK.US The Technology Select Sector SPDR® Fund ETF tracks the technology sector of the S&P 500 Index.

Why trade ETFs on Deriv

A low-cost way to trade diverse asset groups

Numerous intraday trading opportunities

Fast, secure deposit and withdrawal options

Powerful, intuitive platforms

Smart and friendly support, 7 days a week

Start trading ETFs on Deriv in 3 simple steps

Practise

Open a demo account and practise with an unlimited amount of virtual funds.

Trade

Open a real account, make a deposit, and start trading baskets and other markets.

Withdraw

Conveniently withdraw your funds through any of our supported withdrawal methods.